Identifying an Externalising Process Configuration Data - in the context of the NCA with Karel van der Walt

Executive Summary

This webinar highlights key themes related to Data Modelling, process configuration, and financial regulation, as discussed by Karl van der Walt. Karl explores the intricate relationship between semantic and predictive modelling, particularly in the context of compliance within business processes and the management of transactional systems. The webinar covers various aspects of the microfinance industry, including the historical evolution and regulatory framework shaped by the National Credit Act, as well as critical factors in loan repayment and credit cost modelling.

Karl shares on the implications of currency exchange rates and interest rate revisions on financial inclusion and contract complexity. Additionally, he emphasises the importance of externalisation, temporality, and parameterisation in configuration management, particularly within multi-tenant systems using XML. The webinar concludes with a discussion on the integration of semantic models and temporal tables in enhancing business technology.

Webinar Details

Title: Identifying an Externalising Process Configuration Data - in the context of the NCA with Karel van der Walt

Date: 07/04/2025

Presenter: Karl van der Walt

Meetup Group: Ins and Outs of Data Modelling

Write-up Author: Howard Diesel

Contents

The Time and Effort Required for Presentation Preparation

Karl van der Walt: Data Modelling, University Teaching, and Online Mathematics Education

Understanding the Complexity and Context of Process Configuration

Importance of Externalisation and Temporality in Process Configuration

Temporal Testing and Data Quality Management

A Historical Overview of the Microfinance Industry and its Regulations

The Interpretation of Case Law

Semantic Modelling and Compliance in Business Processes

Semantic and Predictive Modelling in Postgres

Understanding the Components of Loan Repayment and Credit Cost Modelling.

The National Credit Act and its Regulations

Currency Exchange Rates and Financial Inclusion in South Africa

Interest Rate Revisions and Contract Complexity

Understanding the Regulation of Initiation Fees in Financial Agreements

Parameterisation of Startup Fees in Multi-Tenant Systems

Management of Control Language in XML

Parameter Selection and Editing in XML Configuration Management

Compatibility of XML with Financial Product Market Language

Challenges and Limitations of Transactional Systems

Closing Discussion: Semantic Model, Transactional Processing, and Temporal Tables in Business Technology

The Time and Effort Required for Presentation Preparation

Howard Diesel opens the webinar and expresses his gratitude to Karl van der Walt for the effort he dedicated to reviewing the presentation over the weekend. Preparing presentations can be quite time-consuming, as there are always new ideas to consider and better ways to articulate them. Howard notes a quote that he has come to appreciate, which suggests that if one had more time, they would write a shorter letter, highlighting how, as we deepen our understanding of a topic, we can communicate it more succinctly. Lastly, Howard shares that he was impressed by Carl's previous presentations and looks forward to hearing more of what he has to share.

Karl van der Walt: Data Modelling, University Teaching, and Online Mathematics Education

Karl shares his extensive experience in Data Modelling and Data Architecture, having previously taught database management systems at Bond University in South Africa. He taught there for two years, during which students pursued a degree in just two years across three semesters each year. Currently, he shares that he is teaching high school mathematics for grades 11 and 12 online, which has provided him with a new teaching experience. He is also in the process of updating his skills in school matriculation mathematics.

Understanding the Complexity and Context of Process Configuration

The presentation focuses on identifying and externalising configuration data, particularly within the context of the regulated short-term credit industry in South Africa, influenced by the National Credit Act and the National Credit Amendment Act. Karl emphasises that process configuration is not atomic; while certain elements like a VAT can be understood independently, others, such as interest rates, require additional context to avoid ambiguity.

This necessitates an aggregate of configuration data that functions as a cascade, where lower-level configurations override higher-level defaults. The speaker will provide insights based on personal experience while clarifying that the information shared should not be considered as accounting or legal advice.

Figure 1 Opening Slide

Figure 2 Introduction Slide

Figure 3 Disclaimer

Figure 4 Conclusion

Importance of Externalisation and Temporality in Process Configuration

The configuration of processes should be externalised rather than hard coded to enhance their flexibility and parameterisation. This approach facilitates quick adaptations to changes in external factors, such as interest rates or VAT, and supports disciplined evolution in response to regulatory constraints.

Externalising configuration allows for easier updates, as minor changes may only require a redeployment or restart of the system, while optimal solutions enable real-time adjustments without requiring a full rebuild. Additionally, maintaining a temporal aspect by preserving historical data is crucial, as it ensures that past calculations can be accurately reproduced, allowing for consistency in results and accountability in production environments.

Temporal Testing and Data Quality Management

Karl moves on to the concept of shift right testing, particularly its application to future and historical data scenarios, like a potential value-added tax (VAT) rate change. This approach allows for explicit override of date parameters, facilitating analysis of data behaviour under specific business rules and conditions at the time of data creation.

By reconstructing the state of transactions, including all relevant metadata and business rules, analysts can effectively trace and resolve data quality issues, ensuring that processes replicate historical outcomes accurately. This method enhances the ability to evaluate transaction processing by enabling users to reprocess payments and investigate discrepancies while maintaining an understanding of the context in which the data was generated.

Figure 5 Chronology - Micro Finance

A Historical Overview of the Microfinance Industry and its Regulations

The microfinance industry has undergone significant regulation since the introduction of the 1968 Act aimed at curbing excessive interest rates on lending. In 1992, an exemption allowed more flexibility for loans under 6,000, which later expanded to 10,000 over 36 months by 1999. This period saw microfinance gain a poor reputation due to an uneven playing field and inadequate collection methods, prompting industry self-organisation and lobbying for improvements.

The International Credit Act was enacted in 2005 to establish a regulatory framework, followed by regulations in 2006 and amendments in 2014 to address reckless lending and enhance due diligence requirements. Despite expectations for relief from fees through reviews by the minister, outcomes have often fallen short, leading to further legal challenges, including appeals to the Supreme Court. As a result, the relationship between the industry, regulator, and minister remains complex, with ongoing clarifications and interpretations impacting the landscape.

The Interpretation of Case Law

The judgment in the 2011 case of Net Bank versus the regulator highlights the challenges associated with interpreting the Act, particularly in the context of common law in Duplin, which has now been revised to refer to statutory law. The judge expressed frustration over numerous drafting errors, inconsistencies, and the complex nature of the law's application.

Despite these challenges, credit was given to the department and the regulator for creating an environment that encourages responsible industry participation and the formulation of effective legal frameworks. Overall, the task of regulating and codifying laws within an Act remains a difficult endeavour.

Figure 6 Case Law

Semantic Modelling and Compliance in Business Processes

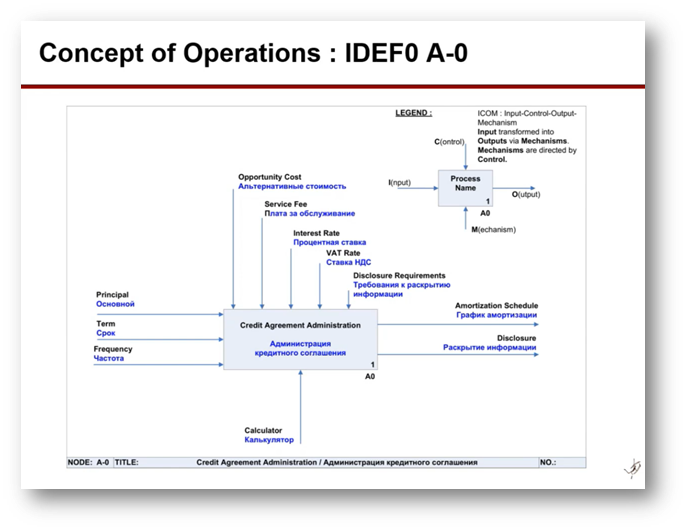

The challenge of interpreting regulatory acts and creating compliant business processes is highlighted through the concept of semantic modelling, as discussed by Wayne Eckerson. This approach emphasises the need for a clear understanding of terminology and the formalisation of regulations, particularly in regulated domains. The focus is on constructing a comprehensive model of the regulatory act and its associated rules, using frameworks like context diagrams and IDEF0 notation. These models should represent not only the top-level functions, such as agreement administration, but also include elements like regulators and relevant acts that inform these processes, facilitating a structured way to handle inputs, outputs, mechanisms, and controls while ensuring compliance.

Figure 7 Semantic Model/ Mind Map

Figure 8 Semantic Model/ Mind Map Pt.2

Figure 9 Concept of Operations : IDEF0 A-0

Semantic and Predictive Modelling in Postgres

Karl shares on a recent Postgres conference focused on translating APR calculations from SQL Server to Postgres, highlighting the importance of decomposing complex elements for clarity. By starting with a mind map, one can create a top-level diagram that organises sections or paragraphs of relevant acts, allowing for easy reference and impact assessment during revisions.

The presentation emphasises distinguishing between configuration and control data, such as origination fees and recurring service fees, while discussing the integration of semantic modelling within both conceptual and physical modelling frameworks. The goal is to provide a clear cost estimate for loans, exemplified by calculating the total cost of a loan, including interest and fees, to derive a unitless ratio that reflects the financial metrics effectively.

Figure 10 Semantic Model/ Mind Map Pt.1

Figure 11 Semantic Model/ Mind Map Pt.2

Understanding the Components of Loan Repayment and Credit Cost Modelling

Focusing on semantic modelling in relation to loans, Karl emphasises the interplay between various components such as the loan amount, initiation fee, and cost of credit. The loan amount, which includes both the principal and any interest-bearing initiation fees, ultimately determines the deferred amount that attracts interest.

Key elements include the yellow box representing total payments, which consist of principal and interest, as well as a monthly admin fee and credit protection options that may cover the original loan amount or the lender's potential income.

By summing all instalments, the total fees can be assessed relative to the original loan amount, resulting in a cost multiple. The calculation process is hierarchical, starting from the lowest elements, such as the loan amount, and progressing upwards to gain a comprehensive understanding of credit costs.

Figure 12 Concept of Operations : IDEF0 A-0

Figure 13 Disclosure Determination : A2

Figure 14 Semantic Model : Metrics Trees

The National Credit Act and its Regulations

When shopping for a loan management system, it's essential to understand the context of working in a regulated industry, particularly under the National Credit Act and its regulations. A key aspect of compliance involves semantic modelling to clarify definitions and terminology, specifically regarding the principal and the deferred amount.

The deferred amount refers to upfront costs added to loan amounts, such as initiation fees or connection fees for rental agreements, which can attract interest similarly to the principal. The Act encompasses various loan types, including mortgage agreements, instalment agreements, and secured loans, highlighting the importance of governance and terminology in navigating these financial frameworks.

The regulations establish parameters for various credit transactions within the microfinance sector, distinguishing between short-term credit transactions (up to six months) and unsecured credit agreements (longer than six months without an asset backing). A key issue arises with the ambiguity surrounding the definition of deferred amounts, particularly regarding whether they include only principal amounts before additional fees are applied.

Challenges arise when calculating interest rates, as short-term agreements specify monthly interest, while unsecured agreements use annual rates, creating discrepancies when converting between the two (360 days vs. 365 days). The regulations also introduce a reference rate for unsecured transactions, which is distinct from but may coincide with the repo rate, complicating the clarity of these agreements.

Figure 15 Upay Technology

Figure 16 Business Glossary - Definitions

Currency Exchange Rates and Financial Inclusion in South Africa

Karl moves on to the complexities of borrowing rates and currency implications in South Africa, particularly the potential for lenders to exploit loopholes by offering loans in currencies like U.S. dollars instead of the South African Rand, which is typically the accepted currency. He highlights the confusion stemming from different rate conventions (such as Act 360 and Act 365) and the challenge of calculating equitable rates.

The repo rate is a central bank borrowing rate rather than an exchange rate, emphasising the adversarial nature of the microfinance industry and its role in promoting financial inclusion. It raises questions about regulations regarding currency-specific loans and explores the nuances of unsecured credit offerings, hinting at potential oversight in financial policies.

Figure 17 Business Glossary - Definitions Pt.2

Figure 18 Business Glossary - Definitions Pt.3

Interest Rate Revisions and Contract Complexity

The complexities and volatility of interest rates and service fees in financial transactions are highlighted by the changing regulations. As regulatory reviews prompt adjustments to interest rates, such as the reduction from 5% to 3% for specific short-term agreements, the industry navigates the intricacies of pre-existing contractual terms that cannot be retroactively altered.

This situation necessitates careful consideration of when fees accrue and how they are invoiced, leading to ambiguity surrounding VAT obligations. The interplay of semantic modelling and historical regulatory contexts signifies that financial agreements are not static and must account for evolving legal frameworks, which complicates the transparency and predictability of financial products.

Figure 19 Interest - Regulations

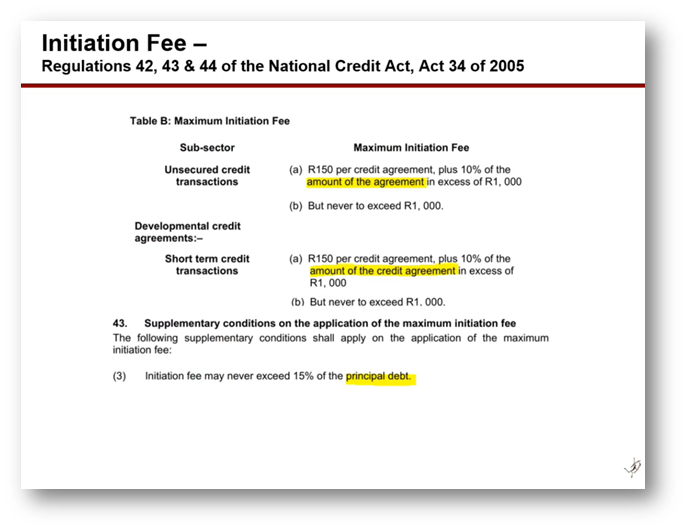

Understanding the Regulation of Initiation Fees in Financial Agreements

The initiation fee structure involves an original fee for agreements under 1,000 and a 10% fee for amounts exceeding that threshold, capped at 1,000. Additionally, Clause 43 stipulates that the initiation fee cannot surpass 15% of the principal debt. This is illustrated in a graph where fees under the 1,000 grand threshold follow a red line, while amounts above it adhere to a purple line due to regulatory constraints.

A revised initiation fee now sets the limit at 165, with the 10% boundary maintained at 1,000 grand. Despite creating the impression of fee relief, the revised structure only results in increased fees in rare cases, suggesting that the convoluted language may obscure the true financial implications.

Figure 20 Interest - Regulations Pt.2

Figure 21 Interest - Regulations Review

Figure 22 Initiation Fee - Regulations

Figure 23 Initiation Fee - Regulations Graph

Parameterisation of Startup Fees in Multi-Tenant Systems

Karl moves on to the initiation fee within a controlled language framework, emphasising its implications in a multi-tenant system where tenants can choose whether to charge interest on the fee based on their VAT registration status. There was debate over whether the initiation fee could be deferred and how VAT obligations apply, particularly whether to recover the initiation fee first or spread it over the loan's duration.

The guidelines from the relevant act specify parameters such as fixed thresholds for initiation fees, which must not exceed set limits (e.g., 10% or 15% of the loan) and a maximum of 1,000 units. Ultimately, the initiation fee introduces nine parameters, with certain items being mandatory due to legal constraints, ensuring that while flexibility exists, adherence to established regulations is essential.

Figure 24 Initiation Fee - Regulations Pt.2

Management of Control Language in XML

The goal is to aggregate and store variations of controlled language parameters, allowing for temporal tracking of different versions. Instead of using individual values, a choice has been made to translate this data into XML with a proper schema, enabling the inclusion of free text and marked-up entities, unlike JSON.

Parameters such as initiation fees are uniquely identified by names, codes, descriptions, and GUIDs, while accommodating various data types, including Boolean and numeric values with defined ranges. A stylesheet can be utilised to present these parameters as interactive elements, like radio buttons or spinners, facilitating the editing of business rules and configuration values.

Figure 25 Initiation Fee - Regulations Graph

Parameter Selection and Editing in XML Configuration Management

The process involves a naming convention for parameters and their default values, which are represented in a separate XML document or fragment. Each parameter from the original rule is included, utilising XML Schema instance types, with Boolean and decimal types deemed sufficient for the domain.

Overrides are indicated, and when users access the edit screen, they see the default values alongside those that cannot be changed for informational purposes. Users can edit their configurations, and upon saving, the system records the effective date using SQL Server's temporal system version tables, streamlining data management. A reference template can be used to display edited values, facilitating user interaction.

Compatibility of XML with Financial Product Market Language

An attendee asks questions regarding the compatibility of his markup language with the Financial Product Markup Language (FPML) and shares their experiences with a related project. The attendee's project deals with the Reverse Rule Markup Language (R2ML), which serves as an interchange format. Karl acknowledges the importance of exploring existing schemas to address potential disambiguation and representation issues. Furthermore, he outlines the complexities in defining service fees and initiation fees using controlled language, emphasising considerations such as fixed versus percentage amounts, payment structures (monthly or by instalment), and how to handle partial months in billing, including the nuances of discounts for incomplete months based on client preferences.

Figure 26 Initiation Fee - Controlled Language

Figure 27 Initiation Fee - Parameters

Figure 28 Config Cascade

Figure 29 Initiation Fee - Arguments

Figure 30 Service - Controlled Language

Challenges and Limitations of Transactional Systems

Creating financial products within defined rules while allowing for user customisation may come with challenges. Karl adds to this by highlighting the importance of configuring parameters for loans, such as interest rates and fees, according to client preferences and compliance regulations. Users can adjust specifics, like discount options and payment frequencies, without crossing established boundaries. The semantic model used in this context aids in defining parameters and their flexibility, including the incorporation of metadata to enhance product functionality. Overall, the goal is to balance user autonomy with regulatory conformity in financial product offerings.

Figure 31 Service - Controlled Language Pt.2

Closing Discussion: Semantic Model, Transactional Processing, and Temporal Tables in Business Technology

Karl and attendees discuss the importance of maintaining a semantic model for product development that aligns with legal and regulatory constraints while allowing for controlled evolution after the product goes live. It explains how transactional processing occurs in a different environment and emphasises the necessity of backwards compatibility when introducing new parameters.

The use of temporal tables is vital to ensure that historical parameters, such as initiation fees, remain unchanged, allowing the system to operate based on specific criteria set as of designated dates. Overall, this approach ensures that any modifications made in response to evolving business needs do not invalidate prior agreements and contractual obligations.

Alternative mechanisms are available beyond the current framework to ensure effective audit and traceability. In a production environment, for example, a seamless transition can be established by quoting an agreement with a start date in June, allowing for verification that the new rates are correctly applied. This approach emphasises the importance of maintaining consistent processes while meeting business requirements.

If you would like to join the discussion, please visit our community platform, the Data Professional Expedition.

Additionally, if you would like to be a guest speaker on a future webinar, kindly contact Debbie (social@modelwaresystems.com)

Don’t forget to join our exciting LinkedIn and Meetup data communities not to miss out!